You Worked Hard To Build a Financial Future. We’re Here to Help You Protect It.

When faced with long term care needs, Indiana seniors are faced with three options to pay for such care. When one takes the time to compare these options, the path forward is clear.

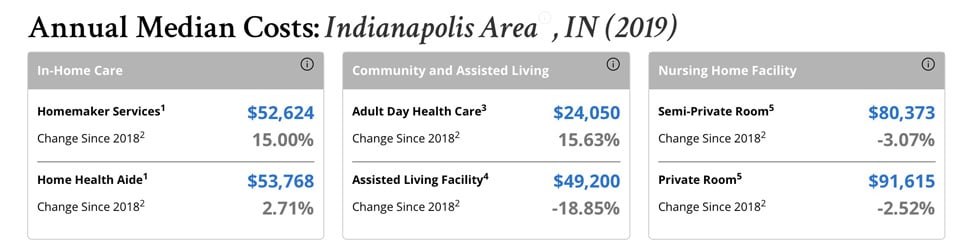

Private Pay – The cost of care in a skilled nursing facility in the Indianapolis metropolitan area is roughly $6,698.00 per month for a semi-private room. The monthly cost for assisted living facilities is approximately $4,100.00. These costs would force most people into complete indigence in a very short period of time. Thinking big picture, an average stay in a nursing home for an Indiana resident is 27 months. Not accounting for inflation, this would be an out of pocket cost of $180,819.00.

Long Term Care Insurance – This is a viable option for some people. However, the reality is that most Indiana elders do not have long-term care insurance in place. Given their age and the health complications that often come with age, it is highly unlikely our senior population could qualify or afford the monthly premiums. Thus, this is often simply not an option.

Need-Based Government Assistance – This option looks at Medicaid and Veteran’s Benefits. In Indiana, Medicaid will pay for almost all nursing homes (we all know there can be big differences between those facilities and people often think the nicest facilities are off-limits to them). Medicaid is also covering an increasing number of assisted living facilities and even care in your own home in some circumstances. Yet, to qualify for Medicaid you have to make sure your assets are in order.

Planning With The Focus On You And Your Family

The above options offer a stark reality for most seniors. This is where Van Winkle Legal can be of great benefit to you. Travis and his team focus on planning for the care and protection you and your family will need. We advocate and advise clients regarding their ongoing needs as they evolve with age. This includes planning for long term care, advising clients of public and private resources to help cover projected costs and protecting/preserving the interests of our clients.

We are often asked what planning this requires beyond a traditional will. The reality is that long term care planning requires solid estate planning but the job does not end there (not by a long shot). 70% of the U.S. population age 65 and over will need long-term care.

We Can Help Today

Start working with Van Winkle Legal now. Don’t wait until you are facing a health crisis to plan for your care needs. To learn how long-term care planning can protect your interests while ensuring you get the care your need, contact us to set an initial consultation at 317-953-2729 or by requesting an appointment by clicking here.